But any excitement dissipated once employees realized that neither Eero nor Amazon was disclosing a price.

Rumors about the specifics of the deal spread quickly. On February 11, Eero announced to the public that Amazon had acquired the company. An ex-employee described it as a period of “desperate fear.” Morale was so low that HR disabled group emailing and prohibited employees from sending out goodbye emails to say they were leaving. “The day they killed was the day the company changed,” said a former employee.Īfter Eero employees returned from the holidays, 20 percent of the staff was cut. Soon after, Eero abandoned Hive, leading to a period of malaise and confusion. The company tried to remain a step ahead and diversify - most notably with Hive, a smart home security system - but then Google dropped a bomb: a similar product called Nest Secure.

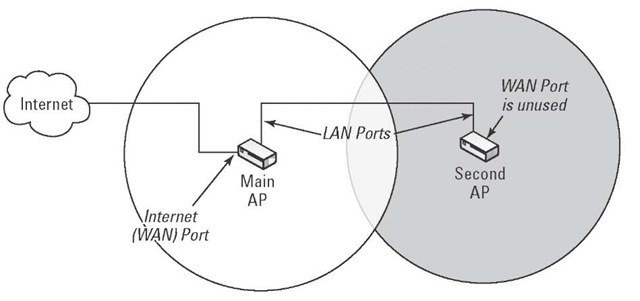

The tech giant launched its own mesh network, Google Wifi, in late 2016, for just $299. Multiple companies including Luma and NetGear launched similar products in the next year.Īccording to former Eero employees, the biggest challenge came from Google. Installing and setting up Eero is simple - no surly cable guy required - and the system is managed via an app on your smartphone.Įero may have been first to mesh WiFi, but competition came fast. Instead of one central modem and router duo, mesh WiFi systems communicate between multiple devices placed throughout a home, which allows the fastest WiFi signals to reach through more physical barriers. Three months after the successful product launch, it had a valuation of over $277 million.Įero's primary product is a "mesh wireless router," which changes the way internet access is delivered throughout the house, resulting in coverage that is faster and more consistent. Reviewers, including at Mashable, were delighted by the performance and the packaging.

Great expectationsĪt its inception, Eero checked off all the boxes for Silicon Valley: a “disruptive” product, chummy co-founders with Stanford pedigrees, an origin story that started in an apartment, and big promises about how its wireless mesh router system would reinvent home WiFi with cutting-edge technology. And even then, your win may still be a loss. If you want to win in the product sector, you want to be on the side of the giants. Creating hardware takes time and money, the sort of money that is usually found in the pockets of tech giants. The circumstances surrounding Eero’s sale to Amazon speaks to how exceedingly difficult it is to compete in the smart home market. Meanwhile, the Eero execs who stay to help Amazon wage its war for smart home domination will take home around $30 million. And those who did exercise options, investing their financial faith in the company, have lost money.Īmazon plans to offer satellite-powered internet It typically would have cost around $3 for employees to exercise their stock, meaning they would actually lose money if they tried to cash out.įormer and current Eero employees who chose not to exercise those options are now empty-handed. Investors took major hits, and the Amazon acquisition rendered Eero stock worthless: $0.03 per share, down from a common stock high of $3.54 in July 2017. Everyone else, however, didn’t fare quite so well. Eero executives brought home multi-million dollar bonuses and eight-figure salary increases. This story is about investors losing tens of millions of dollars and dozens of employees left with meaningless stock.Īccording to confidential documents viewed by Mashable, Amazon acquired Eero for $97 million. When Amazon announced a deal to acquire Eero, the maker of a groundbreaking WiFi system, it sounded like a classic Silicon Valley success story: a promising startup is acquired by the biggest bidder in the land, and everyone rolls around in cash.

0 kommentar(er)

0 kommentar(er)